Ever stared at a prescription receipt and wondered how the same pill costs $4 at one pharmacy and $42 at another? You’re not alone. In the U.S., generic drug prices vary wildly - sometimes by hundreds of percent - even within the same city. The reason? A tangled web of rebates, pharmacy benefit managers (PBMs), insurance contracts, and hidden discounts that no one outside the system fully understands. But now, tools exist to cut through the noise. You don’t need a degree in healthcare finance to find the lowest price for your meds. You just need the right tools.

Why Generic Drug Prices Are So Confusing

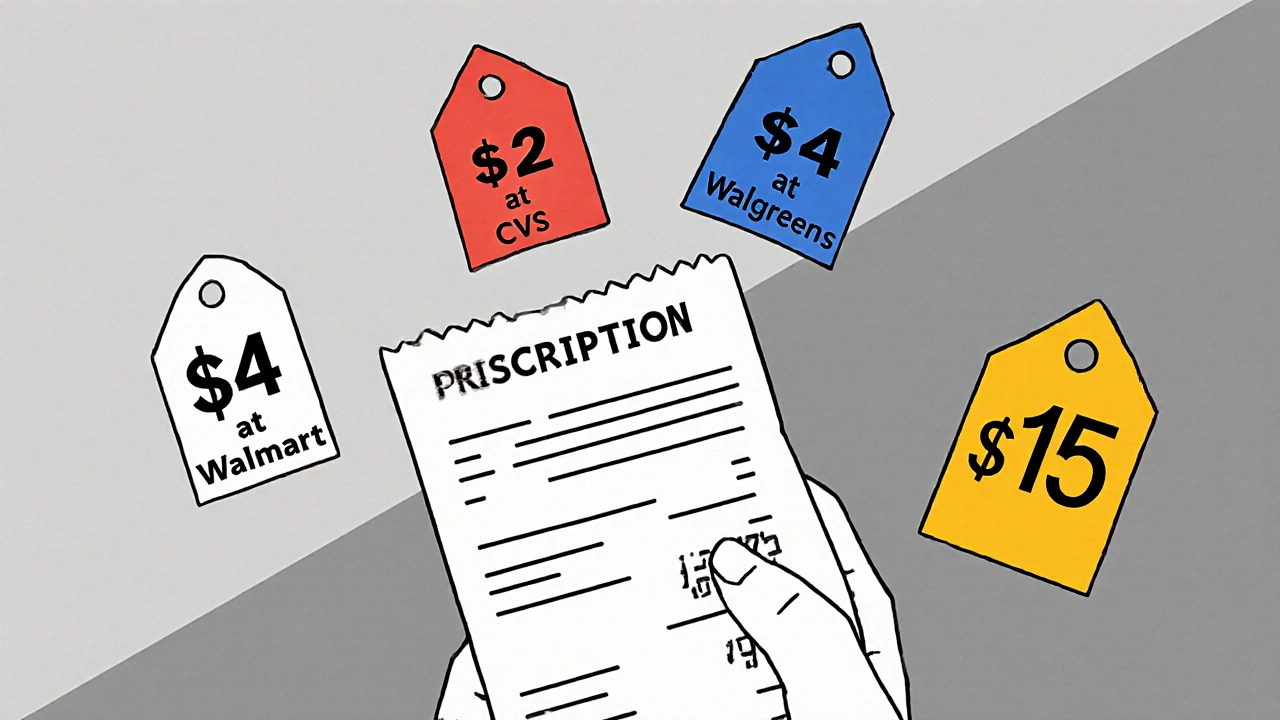

Generic drugs are supposed to be cheaper. They’re the same active ingredients as brand-name pills, just without the marketing budget. But here’s the catch: the price you see on the shelf isn’t the real price. What you pay depends on your insurance plan, which pharmacy you use, whether your insurer has a deal with that pharmacy, and even what day of the week it is. Pharmacy Benefit Managers (PBMs) like CVS Caremark, Express Scripts, and OptumRx negotiate discounts with drugmakers. But those discounts - called rebates - rarely show up on your receipt. Instead, pharmacies get paid based on something called the Wholesale Acquisition Cost (WAC), which is often way higher than what the PBM actually paid. That’s why you see $15 for a 30-day supply of metformin at your local CVS, but $3 at Walmart. One price is the list price. The other is the real price after rebates. And it gets worse. Some pharmacies don’t even know what your insurance will cover until they run your card. That’s why you’ve probably walked out of a pharmacy thinking you got a great deal - only to get a bill later saying you owe $80.Real-Time Benefit Tools (RTBTs): What Doctors Use

If you’ve ever had your doctor switch your prescription mid-visit because of cost, you’ve seen a Real-Time Benefit Tool (RTBT) in action. These are systems built into electronic health records like Epic and Cerner. When your doctor types in a prescription, the tool pulls up your specific insurance details - including your copay, deductible, and what alternatives your plan covers. CoverMyMeds and Surescripts are the two biggest RTBT platforms. By 2025, about 42% of U.S. physician practices used them. They don’t just show prices - they show you which generic versions are covered, whether a prior authorization is needed, and even if you qualify for free drug programs from manufacturers. One doctor in Ohio told me his patients’ out-of-pocket costs dropped 37% after he started using RTBTs. He switched a patient from a $90 brand-name statin to a $7 generic. The patient didn’t even know the original drug existed. That’s the power of real-time data. But RTBTs aren’t perfect. They rely on up-to-date insurance data. If your plan changed its formulary last week and the system hasn’t synced yet, you’ll get outdated info. And they only work if your doctor uses them - which many don’t, especially in small practices.GoodRx and Other Consumer Apps: What You Can Use Today

You don’t need to wait for your doctor to use a fancy system. Tools like GoodRx, SingleCare, and RxSaver are free apps and websites that show you the lowest cash price for your generic meds across hundreds of pharmacies. GoodRx is used by 43% of U.S. pharmacies, according to J.D. Power’s 2024 survey. You type in your drug name, zip code, and dosage. It shows you prices at CVS, Walgreens, Walmart, Target, Costco - even local independents. You can print a coupon or show the barcode on your phone at checkout. Many users save $50 or more per prescription. But here’s the catch: the price you see isn’t always the price you pay. A 2025 Trustpilot review summed it up: “The app says $4. I get there, and they say $15.” Why? Because those prices are for cash payers. If you’re using insurance, the pharmacy might not honor the coupon. Or the coupon might only apply to certain versions of the drug. Always ask: “Can you check the price with my insurance first?” Some apps, like SingleCare, work with insurance. They’re not coupons - they’re discount programs that negotiate lower prices directly with pharmacies. If your insurance doesn’t cover your drug, or your copay is too high, these can be lifesavers.State Laws Are Changing the Game

As of April 2025, 23 U.S. states have passed laws forcing drugmakers to report price hikes. Minnesota went further: it created a Prescription Drug Affordability Board that can cap prices for certain drugs. California requires manufacturers to justify any price increase over 16% in two years. In Minnesota, one patient used the state’s transparency portal and found a 92% price difference for the same generic blood pressure pill between two pharmacies just five miles apart. She saved $287 a year. That’s not a fluke. It’s the result of public data. Some states even require pharmacies to post prices online. In New York, pharmacies must list cash prices for the 50 most common generics on their websites. You can compare them before you walk in.What You Can Do Right Now

You don’t need to wait for legislation or your doctor to catch up. Here’s how to take control today:- Always ask for the cash price - even if you have insurance. Sometimes it’s cheaper.

- Use GoodRx or SingleCare to compare prices before you leave home.

- Ask your pharmacist: “Is there a lower-cost generic version?” Sometimes they have options not listed in your app.

- Check RxAssist.org - it’s a free database of manufacturer assistance programs. If you make under $50,000 a year, you might get your meds for free.

- If your insurance denies coverage, ask for a formulary exception. Many plans approve it if you show a cheaper alternative exists.

The Big Problem: Rebates Still Hide the Real Price

Here’s the truth no one talks about: transparency tools only show you the list price (WAC), not the net price after rebates. That’s the real cost - the amount the PBM actually paid the drugmaker. But that number is locked behind contracts. Even the best RTBT can’t show it. That’s why some experts say price transparency is a half-measure. If the system rewards PBMs for pushing expensive drugs (because they get bigger rebates), then showing you the list price doesn’t fix the problem - it just makes you pay more attention to it. The 2025 Drug-price Transparency for Consumers Act (S.229) tried to fix that. It would force drug ads to show the WAC for a 30-day supply. But it doesn’t touch rebates. And in March 2025, the federal government canceled the Medicare Two Dollar Drug List Model - a program that would’ve capped prices for 100 common generics. So while tools help, they’re not a cure. They’re a flashlight in a dark room. You can see the obstacles - but you still have to walk around them yourself.What’s Next? The Future of Drug Pricing

The market for price transparency tools is growing fast. It was worth $2.17 billion in 2024 and is expected to hit $4.89 billion by 2029. Hospitals are adopting these tools faster than small clinics - 78% versus 42%. That’s because hospitals face bigger penalties if they don’t publish their prices. The next big shift? Integration. Tools will soon connect directly to your patient portal. You’ll see your drug costs before your appointment. Your doctor will get alerts if your copay is over $50. You’ll get a text: “Your metformin is $3 at Walgreens. Want me to switch it?” But until rebates are made public - until the real price is visible - we’re still playing a game where the rules are hidden.Final Tip: Don’t Just Accept the First Price

Your medication shouldn’t be a lottery. The same pill shouldn’t cost more than your lunch. Use the tools. Ask questions. Compare. Call three pharmacies. Use a coupon. Talk to your pharmacist. You have more power than you think. One woman in Texas saved $1,200 a year just by switching from CVS to a local pharmacy that used a different PBM. She didn’t change her insurance. She didn’t change her drug. She just changed where she picked it up. That’s the power of price transparency. Not magic. Not legislation. Just knowing where to look.Why is my generic drug so expensive even though it’s not a brand name?

Generic drugs are supposed to be cheaper, but prices vary because of how insurance and pharmacy benefit managers (PBMs) work. The price you see at the pharmacy is often the list price (WAC), not the actual price after rebates. PBMs negotiate discounts behind the scenes, but those savings rarely reach you. Some pharmacies get better deals than others, which is why the same pill can cost $3 at Walmart and $45 at CVS.

Can I use GoodRx with my insurance?

GoodRx is designed for cash payments, not insurance. If you use a GoodRx coupon, the pharmacy will process it as a cash transaction, and your insurance won’t be billed. But sometimes, the cash price with GoodRx is cheaper than your insurance copay. Always ask the pharmacist to check both options - your insurance price and the GoodRx price - before paying.

Do price transparency tools work for specialty medications?

They’re less reliable for specialty drugs. Many RTBTs and apps like GoodRx don’t include high-cost medications like those for MS, cancer, or rheumatoid arthritis. These drugs often require prior authorization, have limited distribution, or are only sold through specialty pharmacies. Your best bet is to contact the drug manufacturer directly - most offer patient assistance programs.

Why does my pharmacy say the GoodRx price isn’t valid?

Some pharmacies don’t honor coupons if your insurance is active, or if the coupon is for a different formulation (e.g., 500mg instead of 250mg). Others may have outdated systems. Always ask: “Can you check the price with my insurance first?” Then ask if the GoodRx coupon applies. If they refuse, try another location - prices vary even within the same chain.

Are there free programs to get generic drugs for little or no cost?

Yes. RxAssist.org is a free database of manufacturer assistance programs. Many drugmakers offer free or low-cost generics to people with low income or no insurance. Programs like NeedyMeds and Partnership for Prescription Assistance can help too. You’ll need to apply, but approval rates are high - 78% of applicants get their meds for free or nearly free.