Imagine you need a prescription for a chronic condition. You walk into the pharmacy, hand over your insurance card, and expect to pay $10. But the cashier says, "That’ll be $120." You’re confused. Why? Because you didn’t understand how your insurance really works. This isn’t a mistake - it’s cost sharing in action. And if you don’t know what deductibles, copays, and coinsurance mean, you’re flying blind when it comes to your healthcare bills.

What Exactly Is Cost Sharing?

Cost sharing is the part of your medical or medication costs that you pay yourself. It’s not your monthly premium - that’s what you pay just to have insurance. Cost sharing kicks in when you actually use care. It includes deductibles, copays, and coinsurance. Together, they determine how much you fork over before your insurance picks up the rest.The system was designed to make insurance cheaper upfront by making you pay more when you use it. It’s not meant to punish you - it’s meant to stop people from using care unnecessarily. But for many, especially those managing long-term conditions, it ends up being a financial trap if you don’t plan ahead.

Deductibles: The First Hurdle

Your deductible is the amount you pay each year before your insurance starts helping with most costs. Think of it like a bucket. You fill it with your own money until it’s full. Only then does your insurance start paying its share.For example, if your deductible is $2,000, you pay 100% of your prescription costs, doctor visits, and lab tests until you’ve spent $2,000. After that, coinsurance or copays take over. Some plans have separate deductibles for prescriptions, so you might pay $1,500 for doctor visits and another $500 for meds - that’s two buckets.

In 2023, the average individual deductible for a marketplace plan was around $1,945. Bronze plans - the cheapest monthly premiums - often have deductibles over $7,000. That means if you’re on a bronze plan and need a $1,200 monthly medication, you pay the full $1,200 until you hit that $7,000 mark. That’s $14,400 in a year just for one drug. No wonder so many people skip doses.

Copays: Fixed Fees at the Point of Care

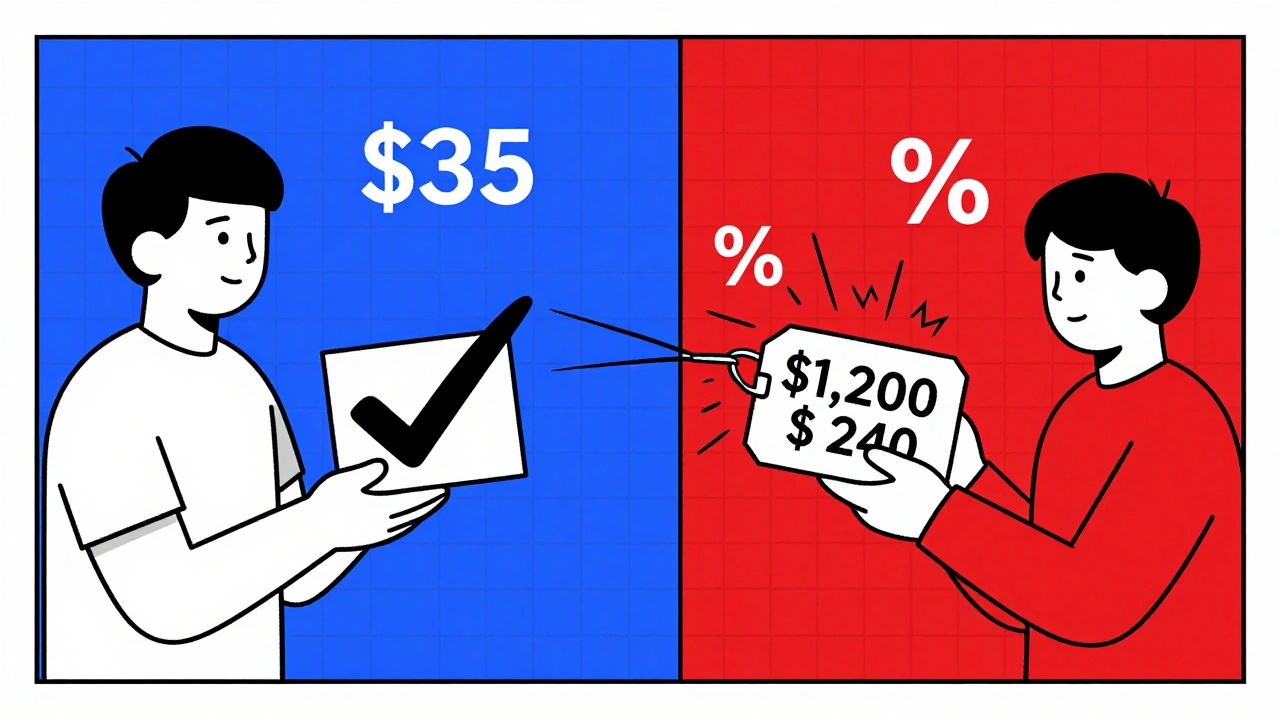

A copay is a flat fee you pay each time you get a service. It’s usually $20-$50 for a doctor’s visit, $40-$75 for a specialist, and $10-$30 for a generic prescription. The key thing? You pay it regardless of how much the service actually costs.Here’s how it works: Your insulin costs $1,000. But your plan has a $35 copay for brand-name diabetes meds. You pay $35. Your insurance covers the rest. That’s the beauty of a copay - it’s predictable.

But here’s the catch: Copays usually don’t count toward your deductible. So if your plan has a $3,000 deductible and a $35 copay for meds, you still have to pay $3,000 in other costs before coinsurance kicks in. That’s why some people with high-deductible plans end up paying hundreds in copays while still being far from their deductible goal.

Also, not all plans use copays. Some use coinsurance only. And some use both - a copay for primary care, coinsurance for specialty drugs. Always check your plan’s Summary of Benefits and Coverage (SBC). It’s the one document insurers are legally required to give you, and it breaks this all down clearly.

Coinsurance: The Percentage Game

Coinsurance is your share of the cost after you’ve hit your deductible. It’s a percentage, not a fixed amount. Common splits are 80/20 or 70/30 - meaning your insurer pays 80% or 70%, and you pay the rest.Let’s say your medication costs $85 after insurance negotiates the price. Your coinsurance is 20%. You pay $17. Your insurer pays $68. Simple. But here’s where it gets tricky: the $85 isn’t the retail price. It’s the negotiated rate your insurer has with the pharmacy. If you go out-of-network, that number could jump to $150 - and your 20% becomes $30. That’s why staying in-network matters so much.

Coinsurance applies to almost everything after your deductible: specialist visits, lab work, hospital stays, and especially expensive medications. If you’re on a biologic for rheumatoid arthritis that costs $5,000 a month, and your coinsurance is 30%, you’re paying $1,500 a month. That’s $18,000 a year. No wonder people delay treatment.

Out-of-Pocket Maximum: Your Safety Net

This is the most important number you need to know. It’s the most you’ll pay in a year for covered services - including deductibles, copays, and coinsurance. Once you hit it, your insurance pays 100% of covered costs for the rest of the year.In 2023, the federal cap was $9,100 for individuals and $18,200 for families. That means even if you’re on a $7,000 deductible plan and pay 30% coinsurance on a $10,000 drug, you’ll never pay more than $9,100 total for everything combined.

But here’s what trips people up: premiums don’t count toward your out-of-pocket maximum. You pay those no matter what. And non-covered services - like cosmetic procedures or out-of-network care without prior approval - also don’t count. So if you go to an out-of-network specialist, you could pay $2,000 out of pocket and still be nowhere near your max.

How These Three Work Together

Let’s say you have a $3,000 deductible, 20% coinsurance, and a $40 copay for prescriptions. You need a $1,200 monthly medication.- Months 1-2: You pay full price - $1,200 each month. You’ve paid $2,400. Still $600 from your deductible.

- Month 3: You pay $600 for your med. Deductible is met.

- Month 4: Now coinsurance applies. 20% of $1,200 = $240. You pay $240. Insurance pays $960.

- Month 5: Same thing - $240.

By month 10, you’ve paid $2,400 (deductible) + $240 × 7 = $1,680 in coinsurance = $4,080 total. Still under your $9,100 max. You’re safe. But if your meds were $2,500/month? That’s $500 coinsurance each month. You’d hit your max by August.

What You Can Do Right Now

You don’t have to guess. You can take control.- Get your Summary of Benefits and Coverage (SBC). It’s required by law. Look for the "Cost Sharing" section. It shows real examples.

- Use your insurer’s online cost estimator. Enter your medication and pharmacy. It’ll show you exactly what you’ll pay.

- Ask your pharmacist: "Is this covered under my plan’s tier? What’s my copay or coinsurance?" They know the details better than you think.

- Check if your drug has a manufacturer coupon or patient assistance program. Many high-cost meds have these - some cut your cost to $0.

- Ask your doctor: "Is there a generic or lower-cost alternative?" Sometimes switching from brand to generic cuts your coinsurance from $500 to $10.

And if you’re on Medicare, remember: the Inflation Reduction Act capped insulin at $35 per month starting in 2023. That’s a game-changer. If you’re not taking advantage of that, you’re leaving money on the table.

Why This Matters More Than Ever

Deductibles have risen 66% since 2010. High-deductible plans now cover nearly half of all workers. And while premiums are lower, your wallet pays the price when you need care. A 2022 study found that 31% of people with chronic illnesses got hit with surprise bills because they didn’t understand how coinsurance worked on specialty drugs.The No Surprises Act (2022) protects you from surprise bills in emergencies - but not from everyday cost-sharing confusion. You still need to know your plan. Otherwise, you’re just hoping for the best.

Understanding deductibles, copays, and coinsurance isn’t just about saving money. It’s about not skipping your meds, avoiding debt, and getting the care you need without fear. It’s the difference between managing your health and being managed by your bill.

Do copays count toward my deductible?

Usually, no. Copays are separate. You pay them each time you get care, but they don’t reduce your deductible. Only payments that go toward your deductible - like coinsurance and full-price services before you meet it - count. Always check your plan’s Summary of Benefits to be sure.

What’s the difference between coinsurance and a copay?

A copay is a fixed dollar amount you pay per visit or prescription - like $30 for a doctor’s visit. Coinsurance is a percentage - like 20% of the cost - that you pay after you’ve met your deductible. So if your drug costs $100 and your coinsurance is 20%, you pay $20. If it costs $500, you pay $100. Copays stay the same. Coinsurance changes with the price.

Can I avoid paying my deductible?

Only if your plan covers certain services before you meet your deductible. Preventive care - like annual checkups, vaccines, and screenings - is usually free under the Affordable Care Act. Some plans also cover a few prescriptions or telehealth visits before the deductible. But for most medications and treatments, you’ll pay until you hit your deductible.

Do all medications count toward my out-of-pocket maximum?

Only if they’re covered by your plan. If your plan doesn’t cover a drug at all, you pay 100% and it doesn’t count. Also, if you go out-of-network without approval, those costs may not count. Always confirm your drug is in-network and on your plan’s formulary. The pharmacy can tell you this before you pay.

Why is my coinsurance so high for my medication?

High-cost drugs - especially brand-name biologics or specialty meds - are often placed in the highest tier of your plan’s formulary. That means higher coinsurance, like 30-50%. Insurance companies do this to encourage the use of cheaper alternatives. Ask your doctor or pharmacist if there’s a similar drug in a lower tier. Sometimes switching saves you hundreds a month.

What happens if I don’t meet my deductible in a year?

You don’t get a refund. Deductibles reset every year. If you spent $1,000 toward a $3,000 deductible and didn’t need more care, you lost that $1,000. Next year, you start over. That’s why people on high-deductible plans often delay care - until they’re forced to pay more later. It’s a risky gamble.

Next Steps: What to Do Today

1. Log in to your insurer’s website and download your Summary of Benefits and Coverage. Look for the "Cost Sharing" section. Highlight your deductible, coinsurance rate, and out-of-pocket max. 2. Call your pharmacy and ask: "What’s my copay or coinsurance for [medication name]? Is it in-network?" 3. Check if your drug has a manufacturer coupon or patient assistance program. Go to NeedyMeds.org or RxAssist.org - they’re free and reliable. 4. Talk to your doctor: "Is there a generic or lower-cost alternative that works just as well?" 5. Set a reminder for December. That’s when your deductible resets. If you’re close to your out-of-pocket max, schedule any needed care before January 1.Health insurance isn’t supposed to be a puzzle. But if you don’t learn the rules, you’ll keep paying more than you should. Take 20 minutes now - it could save you thousands later.