Pharmacies don’t just fill prescriptions-they manage a complex web of inventory, and the biggest piece of that puzzle is generic medications. While brand-name drugs grab headlines with their high prices, generics make up 90% of all prescriptions filled in the U.S. But they only account for about 20% of total drug spending. That’s the sweet spot: high volume, low cost. The problem? Most pharmacies still treat them like afterthoughts. And that’s where they lose money.

Think about it: if you’re running low on metformin, a patient walks out without their medication. If you overstocked on a generic that just got replaced by a cheaper version, you’re stuck with expired pills you can’t return. Both scenarios cost you sales, trust, and cash. The solution isn’t more staff or bigger shelves-it’s smarter inventory systems built for how generics actually behave.

Why Generic Stocking Isn’t Like Brand-Name Inventory

Brand-name drugs often have predictable demand. A patient gets a prescription, refills it monthly, and sticks with it for years. Generics? Not so much. They’re volatile. A new generic hits the market, and suddenly the brand-name version’s sales drop 80% in weeks. If your system doesn’t adjust automatically, you’re left with $10,000 worth of obsolete inventory.

Here’s the reality: generics have 30-50% lower acquisition costs than brands. That means you can afford to carry more of them. But that also means you can afford to lose more if you don’t manage them right. A pharmacy that holds 65-75% of its total inventory value in generics is doing it right. One that holds 40%? It’s leaving money on the table-or worse, drowning in expired stock.

Another key difference? Shelf life. Generic manufacturers often cut costs by using less stable packaging or shorter expiration dates. A brand-name blood pressure pill might expire in 36 months. The generic? 24 months. If you don’t track expiration dates by batch, you’re gambling with waste.

The 80/20 Rule in Pharmacy Inventory

It’s not just a business theory-it’s a pharmacy fact. Around 80% of a pharmacy’s drug costs come from just 20% of the medications on the shelf. And guess what? That 20% is mostly generics. High-turnover items like lisinopril, atorvastatin, metformin, and omeprazole dominate this group.

So why do so many pharmacies treat every generic the same? They don’t. The best-run pharmacies separate their inventory into three tiers:

- Fast movers (top 10% of volume): These are the daily drivers-meds you sell 10+ units a day. You want at least a week’s supply on hand. No exceptions.

- Medium movers (next 30%): These refill every 2-4 weeks. Keep 2-3 weeks’ supply. Order weekly.

- Slow movers (the rest): These are niche generics-maybe 1-2 prescriptions a month. Order only when needed. Don’t stockpile.

One independent pharmacy in Bristol cut its inventory value by 22% in six months just by removing slow-moving generics. They didn’t stop carrying them-they just stopped buying them in bulk. Now they order one bottle at a time. No waste. No overstock.

How to Set Your Reorder Points (ROP) and Reorder Quantities (ROQ)

You can’t guess when to restock. You need math. Two formulas do the heavy lifting:

Reorder Point (ROP): (Average Daily Usage × Lead Time in Days) + Safety Stock

Let’s say you dispense 15 bottles of generic metformin a week. That’s about 2.1 bottles per day. Your supplier takes 5 days to deliver. You add a 3-bottle safety buffer.

ROP = (2.1 × 5) + 3 = 13.5 → Round up to 14.

That means when your stock hits 14 bottles, you trigger an order. Simple. No more running out on Friday afternoon.

Reorder Quantity (ROQ): Use the Economic Order Quantity (EOQ) model. It balances ordering cost against storage cost. Most pharmacy software does this automatically if you input:

- Annual usage

- Cost per unit

- Ordering cost per shipment

- Carrying cost per unit per year

For fast-moving generics, EOQ usually lands between 2-4 weeks’ worth. For slow movers? Order one unit at a time.

The Minimum/Maximum Method: Your Best Friend for Generics

This is the most reliable method for independent pharmacies. You set two numbers for every generic:

- Minimum: The lowest stock level before you reorder. This is your ROP.

- Maximum: The most you should ever have on hand. This prevents overstocking.

For example:

| Medication | Min | Max | Typical Daily Use |

|---|---|---|---|

| Generic Lisinopril 10mg | 20 | 60 | 5.5 |

| Generic Metformin 500mg | 30 | 90 | 8.2 |

| Generic Omeprazole 20mg | 15 | 45 | 3.1 |

| Generic Glimepiride 1mg | 5 | 15 | 0.8 |

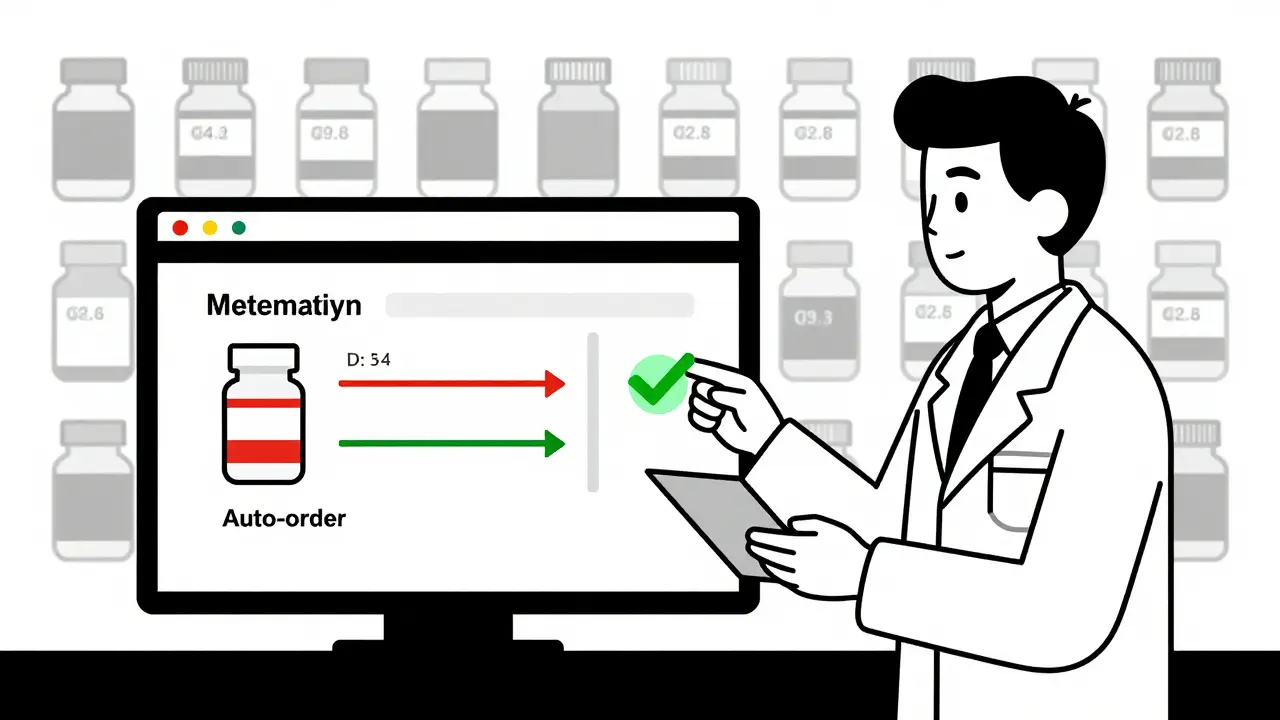

When stock drops below the minimum, the system auto-orders enough to hit the maximum. No manual input. No delays. No guesswork.

How to Handle New Generics Without Overstocking

When a new generic enters the market, demand for the brand-name version plummets. But if your inventory system doesn’t adjust fast enough, you’re stuck with expired stock.

Here’s what works:

- As soon as a new generic is approved, check its pricing and expected demand.

- Reduce your order size for the brand-name version by 50% immediately.

- Start ordering the generic in small batches-just 10-15 units.

- Track weekly sales. If sales hit 15+ units per week, increase your maximum to match.

- Stop ordering the brand-name version entirely once generic sales exceed 80% of total volume.

One pharmacy in Bristol lost $3,200 in brand-name atorvastatin inventory because they waited two months to adjust. They now use a software feature that flags new generic entries and auto-adjusts order parameters. It’s saved them over $15,000 in avoided waste in 18 months.

Don’t Ignore Expiry Dates and Returns

Generics often have shorter shelf lives. And unlike brand-name drugs, manufacturers rarely offer return credits for expired generics. So you’re stuck with it.

Implement a weekly expiry audit:

- Flag any generic with less than 3 months left.

- Offer it to patients who need it now-especially those on fixed incomes.

- If it’s still sitting there after 2 months, contact your wholesaler. Some will take back unopened stock for credit.

- Log every return. Over time, you’ll see which suppliers have the worst expiry rates-and switch.

One pharmacy reduced expired inventory by 60% in a year just by starting this routine. They also started asking patients: “Do you need this now?” before refilling. It cut waste and built loyalty.

Staff Training Is Non-Negotiable

Software doesn’t fix bad habits. If your techs don’t know how to log returns, update stock counts, or recognize a new generic on the shelf, your system will fail.

Train your team on:

- How to return unclaimed prescriptions within 24 hours (this alone cut inventory errors by 22% in one pharmacy).

- What to do when a patient asks for a generic that’s out of stock.

- How to use the inventory system’s alerts-not ignore them.

Make SOPs simple: “When min hits, order to max. When expiry is less than 90 days, flag for patient offer.” No jargon. No confusion.

What Happens When You Get It Right

Pharmacies using these strategies see:

- 10-15% lower inventory holding costs

- 15% fewer stockouts

- 12-18% higher inventory turnover

- 30-40% less waste from expired stock

And here’s the kicker: they’re not spending more on software. They’re just using what they have better.

One independent pharmacy in Bristol went from 18 stockouts in 3 months to 2. Their patients noticed. Their profit margin jumped 14%. They didn’t hire anyone. They didn’t expand. They just started managing generics like they mattered.

How often should I review my generic inventory levels?

Review your inventory at least once a week. Fast-moving generics need daily checks if you’re not using automated alerts. Slow movers can be reviewed monthly. But never go longer than two weeks without looking at your stock levels. The generic market changes too fast to wait.

Should I stock multiple brands of the same generic?

Yes-for fast-moving generics. Patients often prefer one brand over another, even if they’re chemically identical. Having 3-4 suppliers on shelf for popular items like metformin or lisinopril reduces the chance of a stockout. It also gives you leverage when negotiating prices. But don’t overdo it. Stick to 2-3 suppliers per generic, and track which ones have the best pricing and shortest lead times.

Can I use the same inventory system for brand-name and generic drugs?

You can, but you shouldn’t treat them the same. Brand-name drugs need lower safety stock and longer lead time buffers because they’re less replaceable. Generics need tighter controls: higher safety stock, shorter reorder cycles, and expiry tracking. Your system should let you set different rules for each. If it doesn’t, upgrade.

What’s the biggest mistake pharmacies make with generic inventory?

Assuming historical data will always predict future demand. Generics are unpredictable. A new competitor enters, a formulary changes, or a patient group shifts preferences overnight. Pharmacies that don’t update their algorithms quarterly end up with 15-20% overstock during transitions. The key is flexibility-not automation.

How do I know if my generic inventory is too high?

Check your turnover rate. If a generic sits on your shelf for more than 90 days without selling, it’s likely overstocked. Also, look at your expiry dates. If more than 5% of your generic stock expires within the next 60 days, you’re buying too much too soon. Use your inventory software to generate a "slow-moving items" report weekly. Cut those orders before they become waste.