When a new product hits the market, you’d expect it to be expensive. High tech. Cutting edge. Premium. But then, within weeks or months, the price crashes. Why? It’s not a sale. It’s not a mistake. It’s first generic entry - and it’s changing how every industry prices its products.

What Exactly Is First Generic Entry?

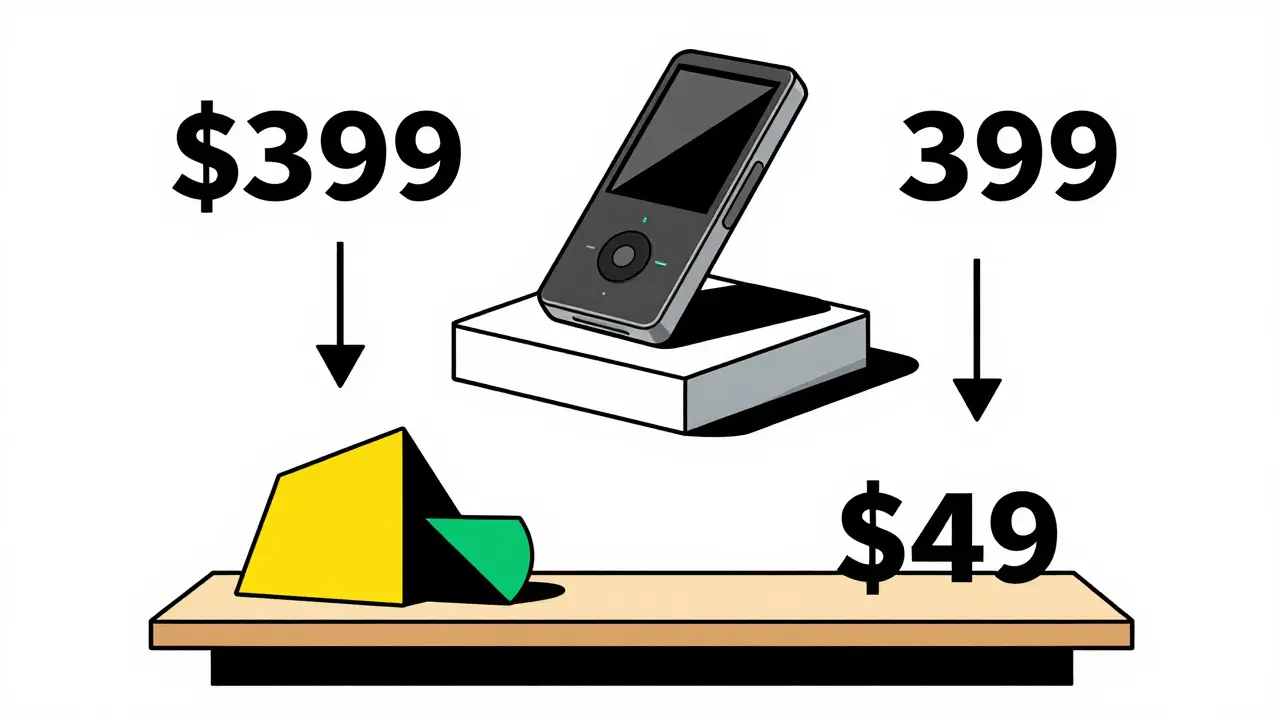

First generic entry happens when a competitor releases a functional alternative to an established product - usually after the original’s patent expires, or by reverse-engineering it. This isn’t about copying. It’s about offering the same core function at a fraction of the cost. Think of it like this: Apple launched the iPod in 2001 for $399. A few years later, dozens of cheaper MP3 players appeared. Within five years, you could buy one for under $50. That’s first generic entry in action. It’s not just consumer electronics. In software, when Oracle’s database cost $10,000 per server, PostgreSQL - a free, open-source alternative - emerged. Companies didn’t just switch. They saved 70-80% on licensing. Same performance. Same reliability. Just way cheaper.Why Do Prices Plummet So Fast?

The answer is simple: competition kills monopoly pricing. When one company owns a market, they can charge what they want. No one else can match them. But the moment someone else builds a version that works just as well, customers have a choice. And customers always choose the lower price - especially when the quality is nearly identical. In pharmaceuticals, the first generic drug launch causes prices to drop an average of 76% within six months, according to the Congressional Budget Office. In enterprise software, the drop is similar. PwC found that first-mover alternatives typically launch at 40-60% below the incumbent’s price. Why? Because they don’t have to recoup billions in R&D. They don’t have to fund massive marketing campaigns. They just need to build something that works. And here’s the kicker: customers don’t care about brand loyalty anymore. Gartner’s 2022 survey showed 72% of enterprise buyers now prioritize total cost of ownership over brand name. If PostgreSQL can do the job of Oracle at 1/5th the price? That’s not a gamble. That’s smart business.How Do Generic Alternatives Keep Costs So Low?

They cut out the fat. Incumbents often charge for things you don’t need - legacy support systems, bloated interfaces, expensive sales teams, and corporate overhead. Generic entrants strip all that away. Take Linux and Apache. These are free, open-source platforms that power most of the internet. Companies building software on top of them don’t pay licensing fees. They pay for talent - and talent in Eastern Europe, India, or Latin America costs far less than in Silicon Valley. One company I spoke with switched from a $200,000/year proprietary CRM to a custom-built open-source alternative. Their annual cost? $35,000. They kept 90% of the features. Lost 10% they never used. Saved $165,000. And their team learned to tweak the system themselves. Generic products also avoid the trap of “feature bloat.” They don’t add 50 buttons no one clicks. They focus on the core function: database, file storage, analytics - whatever it is. That’s why they’re faster, lighter, and cheaper.

It’s Not Just About Price - It’s About Timing

The real power of first generic entry isn’t just the price drop. It’s the speed. In 2010, it took an average of 18 months for a generic alternative to appear after a product launched. Today? Six months. That’s a 67% faster response time. Why? Because tools have gotten better. Cloud infrastructure lets developers spin up servers in minutes. Open-source code is everywhere. AI helps reverse-engineer APIs. You don’t need a team of 50 engineers anymore. One smart developer with a GitHub account can build a viable alternative. And when that alternative drops, incumbents panic. They lower prices. They change their models. Microsoft did this with Azure SQL Database - within six months of competitive pressure, they switched from fixed licenses to pay-per-use pricing. Their effective price dropped 35% for mid-sized companies. The lesson? If you’re an incumbent, you’re not competing with other companies. You’re competing with time. Every day you wait, someone is building a cheaper version.What Do Users Really Think?

You might think people avoid generic alternatives because they’re “risky.” But data says otherwise. On G2, a platform where businesses review software, first-mover generic products average 4.5 out of 5 stars within their first year. The top reason? “Massive cost savings without losing functionality.” One Reddit user wrote: “We migrated from Oracle to PostgreSQL. Our monthly bill dropped from $12,000 to $2,600. Performance? Better. Downtime? Less. We didn’t lose a single feature we needed.” Yes, there are downsides. 28% of early adopters report integration headaches. 62% of companies outsource data migration at first. Documentation isn’t always as polished. But here’s the thing: 81% of those who stick with the alternative keep using it after six months. Why? Because the savings are real, and the pain fades.

What Happens to the Original Company?

They adapt - or die. Some try to fight it. They sue. They lock customers in with contracts. They claim the alternative is “unreliable.” But customers aren’t fooled. They’ve seen the numbers. The smart ones pivot. They stop selling licenses. They start selling support, training, customization, and cloud hosting. MongoDB did this brilliantly. They gave away their database for free but charged for managed cloud hosting (Atlas). That model now captures 15% of Oracle’s former market. Others go all-in on usage-based pricing. Instead of charging $10,000 per server, they charge $0.10 per query. That’s harder to compare - but it’s also harder to undercut. The future isn’t about owning software. It’s about owning access. And that’s exactly what generic entrants are forcing incumbents to become.Should You Wait for the Price Drop?

If you’re a business looking to buy software, the answer is yes - but with a caveat. Wait until the first generic alternative has been out for at least 6-9 months. That’s when most bugs are fixed, support is stable, and community documentation is solid. Jump in too early, and you’ll be the guinea pig. But don’t wait too long. If you’re still using a $50,000/year system and a $5,000 alternative exists? You’re leaving money on the table. Start by asking: “What’s the bare minimum I need this tool to do?” Then search for open-source or freemium versions. Look at G2 reviews. Check GitHub activity. Talk to other users. You’ll find that 80-90% of the functionality you need is already out there - and it’s cheaper.The Bigger Picture: This Is Just the Beginning

This isn’t a trend. It’s a transformation. ARK Invest predicts open-source alternatives will capture 35% of traditional enterprise software revenue by 2027. That’s up from 18% in 2023. Why? Because cloud-native tools make it easier than ever to build and deploy alternatives. The barrier to entry has dropped 60-70% since 2015. The EU’s Digital Markets Act now requires interoperability - meaning you can switch systems without getting locked in. That’s another nail in the coffin of premium pricing. Companies that still believe they can charge premium prices because they’re “the original” are living in the past. Customers aren’t loyal to brands. They’re loyal to value. And value? It’s no longer tied to who built it first. It’s tied to who delivers the best result for the lowest cost. First generic entry isn’t a threat. It’s a reset. A correction. A return to fairness in pricing. The next time you see a product’s price drop suddenly after launch? Don’t assume it’s a sale. Assume someone else just built a better deal.What triggers a price drop right after a product launches?

A price drop right after launch is usually triggered by the arrival of a first generic alternative - a competitor offering similar functionality at a fraction of the cost. This often happens after patents expire or when companies reverse-engineer the original product. The new entrant doesn’t need to recover massive R&D costs, so they can price aggressively, forcing the original vendor to lower prices to stay competitive.

Are generic alternatives as reliable as the original products?

Yes, in most cases. First generic alternatives typically match 80-90% of the original’s core functionality. For example, PostgreSQL delivers nearly all the features of Oracle Database but at 70-80% lower cost. While early versions may have minor gaps in documentation or support, after 6-12 months, most generic products become stable and reliable. User reviews on platforms like G2 show 4.5+ star ratings and 63% of users cite “no loss in functionality” as their main reason for switching.

Why do companies still pay high prices when cheaper options exist?

Some companies stick with expensive products out of habit, fear of change, or because they’re locked into long-term contracts. Others believe the brand guarantees support or security - even though many generic alternatives now offer 24/7 support and enterprise-grade SLAs. The real barrier isn’t quality - it’s inertia. But as more organizations adopt alternatives and report cost savings of 35-78%, that mindset is shifting fast.

How long should I wait before switching to a generic alternative?

Wait 6-9 months after the first generic alternative launches. That gives time for critical bugs to be fixed, community support to grow, and documentation to improve. Jumping in too early can mean dealing with unstable releases or poor onboarding. But waiting longer than a year means you’re missing out on significant savings. The sweet spot is after the first wave of early adopters has validated the product.

Can small businesses benefit from first generic entry?

Absolutely. Small businesses benefit the most. While big enterprises might have legal teams to negotiate licenses, small teams don’t have that luxury. A $5,000 annual software bill can be the difference between profit and loss. Switching to a $500 alternative - like using PostgreSQL instead of SQL Server - can free up cash for hiring, marketing, or product development. Many small businesses report ROI within 6-9 months after switching.